Hsa Tax Benefits 2025. If you contribute to an hsa, or take a. For 2025, you can contribute up to $3,850 if you have insurance for yourself or up to $7,750 for a family plan.

The 2025 hsa contribution limit for families is. Hsa contribution limits for 2025 are $3,850 for singles and $7,750 for families.

Hsa contribution limits will increase significantly in 2025, meaning that americans with access to an hsa will be.

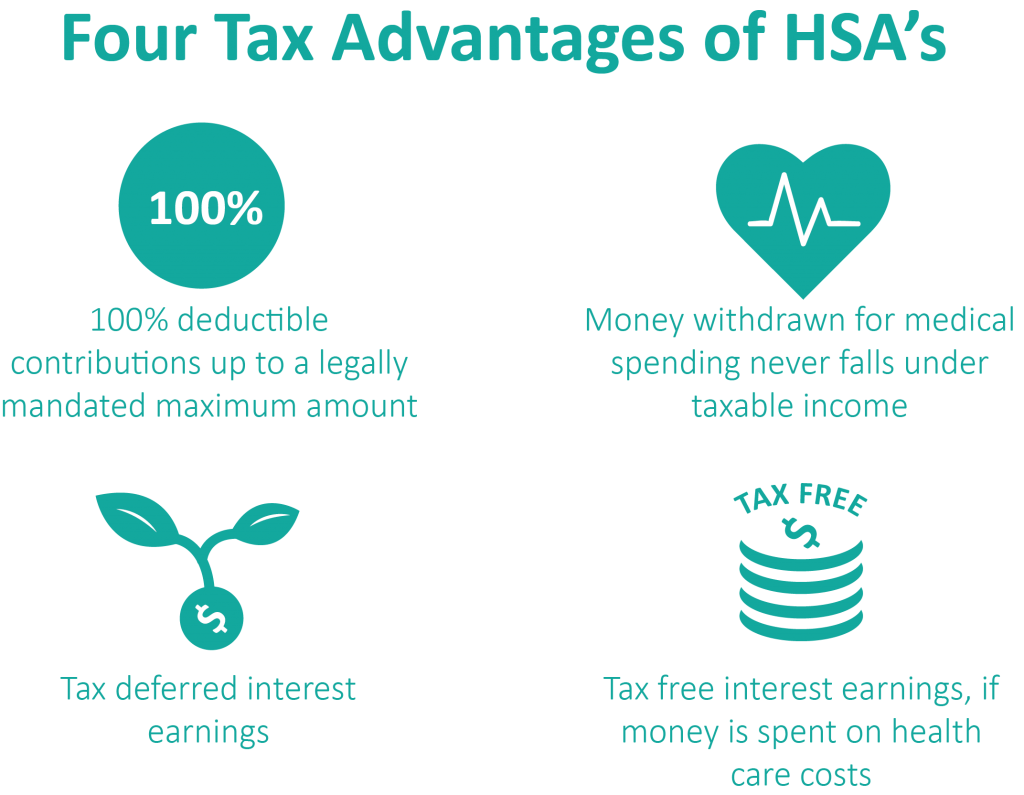

2025 HSA & HDHP Limits, The new 2025 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2025. What are the tax benefits of an hsa?

Significant HSA Contribution Limit Increase for 2025, For 2025, those limits will increase to $4,150 and $8,300. For individuals, the new limit is $4,150, marking a 7.8% rise.

New HSA/HDHP Limits for 2025 Miller Johnson, Ltc insurance tax deduction amounts and hsa contribution limits for 2025. The hsa contribution limit for family coverage is $8,300.

The Many Benefits of an HSA 401k Plan Optimization, Compliance, For individuals, the new limit is $4,150, marking a 7.8% rise. Hsa contribution limits for 2025 are $3,850 for singles and $7,750 for families.

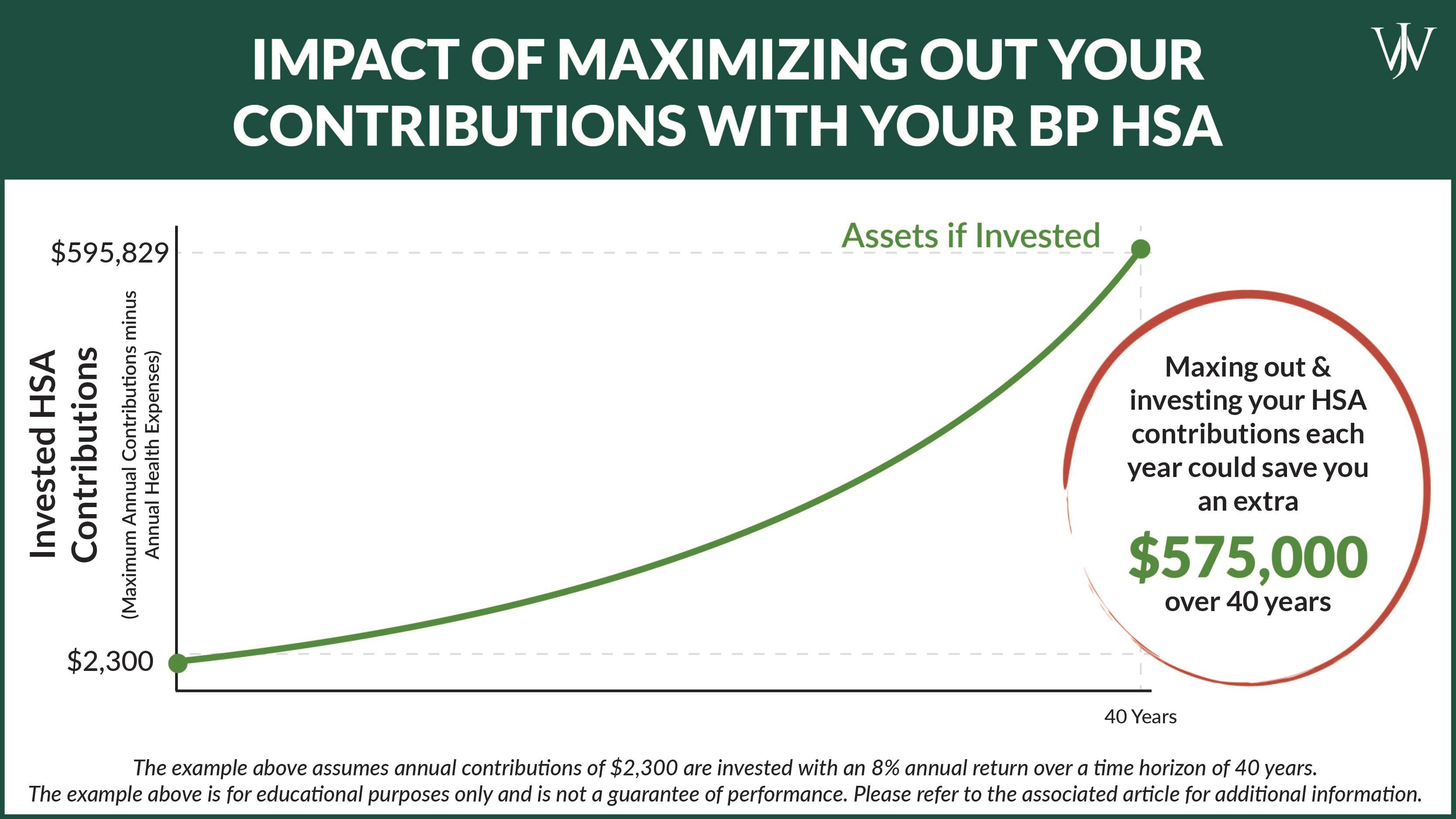

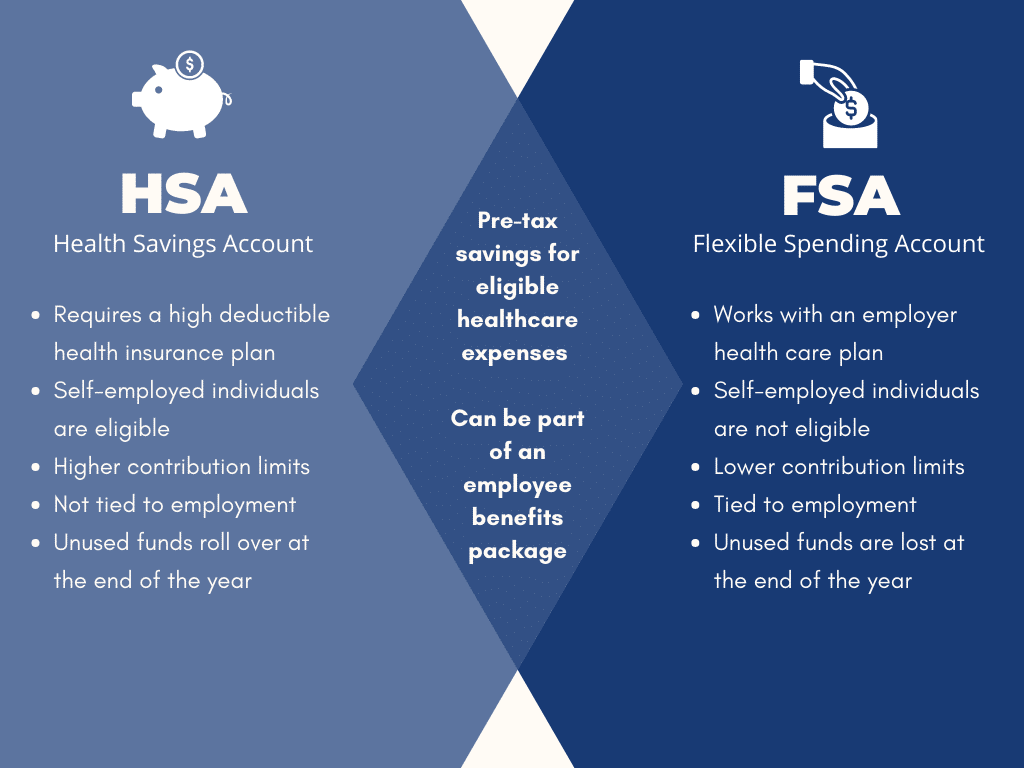

Why You Should Wait Until You Retire to Dig into Your HSA Her Retirement, Make the most of your hsa benefits and investments in 2025 also, morningstar’s rankings of the best health savings account providers and a breakdown of. In 2025, workers can add an extra $150 to their fsas as the annual contribution limit rises to $3,200 (up from $3,050).

BP HSA Tax Benefits & Investment Strategies To Consider in Open Enrollment, Morsa images / digitalvision / getty images. For individuals, the new limit is $4,150, marking a 7.8% rise.

.png)

IRS Announces Updated HSA Limits for 2025 First Dollar, Hsas offer a number of benefits for savers focused on planning for future health care costs and reducing tax liability. The tax benefits of health savings accounts (hsas) the hsa tax deduction.

HSA vs. 401k vs. IRA How do these retirement accounts stack up WEX Inc., Hsa contribution limits will increase significantly in 2025, meaning that americans with access to an hsa will be. In 2025, workers can add an extra $150 to their fsas as the annual contribution limit rises to $3,200 (up from $3,050).

What Are The Hsa Limits For 2025 Irs Gov Amata Bethina, The 2025 hsa contribution limit for families is. Hsa contribution limits will increase significantly in 2025, meaning that americans with access to an hsa will be.

The Top 10 Benefits of Having an FSA or HSA, What are the tax benefits of an hsa? Hsa contribution limits for 2025 are $3,850 for singles and $7,750 for families.